Credit cards can be a convenient way to manage expenses, offering perks like rewards and fraud protections. However, they’re not always the best option for every financial transaction. Using a credit card in situations where the risks outweigh the benefits can lead to financial pitfalls. Whether it’s the risk of accruing high interest rates or the temptation to overspend, knowing when to avoid swiping your card is crucial for maintaining financial health. In this post, we’ll explore five specific situations where reaching for your credit card might not be the smartest choice, providing you with insights to make more informed decisions.

1. Cash Advances

Using your credit card for cash advances can be a costly mistake. These transactions often come with steep fees and high interest rates, which can start accruing immediately. Unlike regular purchases, there’s typically no grace period, meaning you’ll start accumulating interest on the amount withdrawn right away.

It might seem convenient in a pinch, but the financial repercussions can quickly add up, making it a less-than-ideal choice. Instead, consider keeping a small emergency fund in a savings account to cover unexpected expenses. This way, you’ll avoid the high costs associated with credit card cash advances.

2. Unsecured Websites

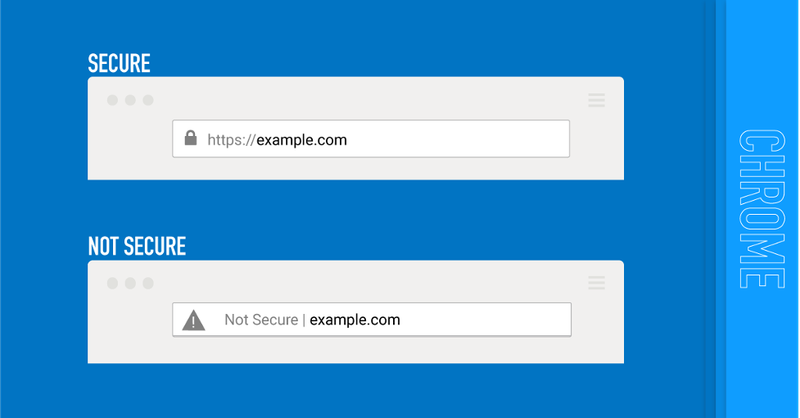

Shopping on unsecured websites can expose you to potential fraud. These sites lack the necessary security measures to protect your personal information, making it easier for cybercriminals to steal your data. Always look for the padlock icon and “https://” in the URL to ensure the site is secure.

If a deal seems too good to be true, it might just be a trap. To safeguard your information, consider using payment services like PayPal, which can offer an extra layer of security when shopping online. Protect your data, stay safe, and shop smart.

3. Impulse Purchases

Impulse purchases can easily break your budget. It’s tempting to swipe your credit card for that must-have item, but these spontaneous buys often lead to buyer’s remorse and financial strain.

Before making a purchase, take a moment to assess if it’s a want or a need. Creating and sticking to a budget can help curb impulsive spending. Consider the long-term impact on your finances and remember the satisfaction of financial stability outweighs the temporary thrill of an impulse buy.

4. Large Purchases Without a Plan

Charging large purchases without a plan can lead to debt. It’s important to evaluate your financial situation before committing to big-ticket items. Plan how to pay off the balance to avoid high interest costs.

If possible, save up and pay in cash to steer clear of accumulating credit card debt. Remember, a well-thought-out purchase is less stressful and more rewarding when it doesn’t burden your finances. Strategic planning and budgeting ensure your big buys don’t become a financial headache.

5. Joint Accounts or Shared Cards

Shared credit cards can complicate relationships. When multiple people have access to the same card, it becomes challenging to track expenses and manage payments. Disagreements over spending habits might arise, leading to tension.

It’s essential to have open communication and establish ground rules for using joint accounts. Alternatively, consider maintaining separate accounts to avoid potential conflicts. This helps in maintaining harmony and clarity in financial responsibilities, ensuring your relationships remain strong and unaffected by financial disagreements.

Well, hello there!

My name is Jennifer. Besides being an orthodontist, I am a mother to 3 playful boys. In this motherhood journey, I can say I will never know everything. That’s why I always strive to read a lot, and that’s why I started writing about all the smithereens I came across so that you can have everything in one place! Enjoy and stay positive; you’ve got this!