Setting aside money from the last salaries before traveling is one of the most common savings scenarios in our lives.

But. saving money is much more than collecting paper banknotes in one place.

Maybe that is why many people don’t want to create savings, and they wonder how to save money in the short term, especially in the long run.

If you think that smart savings methods don’t exist…don’t worry.

Smart methods for saving money exist and are not intended for the wealthy, from whom this task is much easier at the beginning.

So, continue reading and find out how to save the money from your salary, for the sea, for the kids’ toys, but also the most important things and life plans.

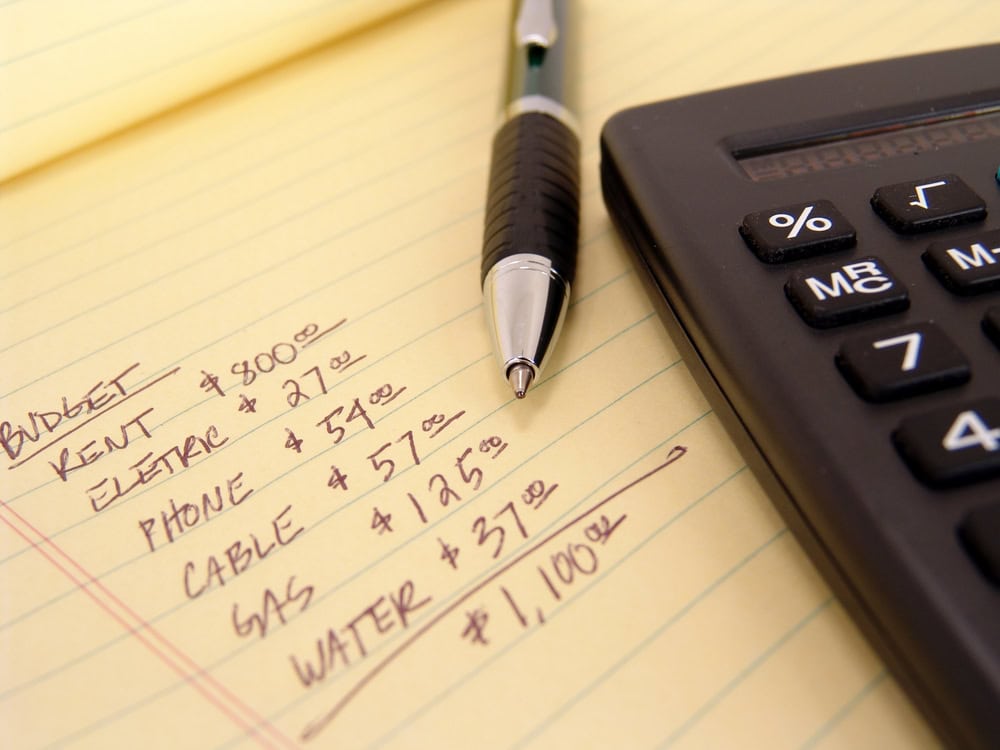

1. Plan and Organize Your Budget

Like all things in life, money requires planning and organizing. First of all, you need to set a budget every month and plan how you will spend the money.

If you know how to plan your future spending properly and efficiently, you will know how and how much money you can save.

We all have found ourselves in a situation where we don’t know how we spend our money, the moment when the end of the month comes, and you don’t know how to survive until the next salary.

This could happen although at the beginning of the month, you may have had a pretty large amount of money in your budget.

The reason for this is poor money management.

So, organization is the key. When you organize your money well, you will see that you can also save it.

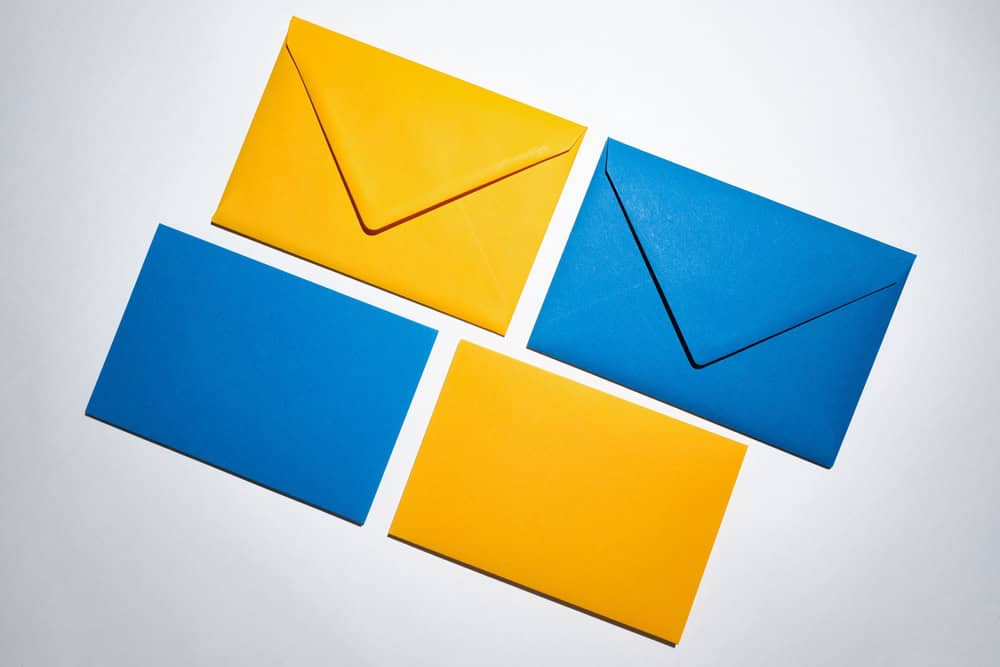

2. ” Envelopes”

A very useful way to plan your spending, and also saving, is to make envelopes.

For example, make four envelopes, or how much you need, and write a category on each one, such as utilities, hygiene, food, rent…

Put as much money in each envelope as is necessary for that category. You mustn’t move money from one envelope to another and strictly stick to your plan.

Then you will see what you spent the money on, and whether it was really necessary. Moderation is indispensable in everything, including spending money.

3. Stop Wasting Money Unnecessarily

Before each purchase, ask yourself if you really need it.

Unnecessarily spending money increases debt and decreases income, so there is no money to save.

4. Saving Money in Banks

Saving in banks is an excellent decision, of course, if you can set aside for the same. In addition to saving your money, the interest you receive on saving money is an excellent extra income.

5. Start Writing Down Expenses and Income

First of all – discover the root of the problem, what it is that takes away the most money every month.

Over one month, take the test, from the first day of the month after receiving your salary, record expenses from the smallest to the biggest, such as rent and bills.

For many people, just writing down expenses is a “discovery” and a great basis for saving money. This technique will teach you that it is possible to save money and afford yourself certain pleasures, but good organization is important.

6. The Method 50 – 30 – 20

One of the popular methods of saving money and the answer to the question of how to save money from a salary is the 50-30-20 method. This method allows everyone to put certain amounts of money aside and simply set priorities.

This method implies that you set aside 50% of your monthly income for needs and what you have to pay, such as bills, food, or rent.

Also, set aside 30% of your income for desires. Desires include expenses such as decorative items, new furniture, buying clothes, shoes, accessories, and the like.

Finally, you need to set aside the rest of your income, 20%, for your savings.

7. “Piggy Bank”

Is the piggy bank forgotten?

Saving money is something we have been taught since early childhood. As a child, each of us received some coins from the family that we kept so that our parents could buy us favorite sweets or toys.

When we think back to that period, the first association is a pink piggy bank in the shape of a pig. This type of money storage has been popular for decades.

These piggy banks can still be found in every shop or market today.

The point of the piggy bank is that it can’t be opened so that the money is not taken before it is really necessary: for someone to do so, the piggy bank had to be broken.

So, that’s how the name bank in the “piggy bank” term comes about, because you can’t just get money out of it.

In addition to being used by children, this method is also practical for adults who can set aside some money and put it into a piggy bank to save it.

As already said, you can’t always take the money from this piggy bank.

Therefore, you don’t have to necessarily use a piggy bank to save money, it can be any money box that can’t be opened.

8. Reduce Compulsive Shopping

Compulsive shopping, as a habit, can damage your budget a lot, especially if you don’t end up using these products at all.

Compulsive shopping is most associated with buying clothes and similar things, and after writing down what you spent your money on each month, you can conclude that you are a victim of consumerism.

In this way, you are needlessly wasting your money that you could save.

So, try to avoid buying useless things. For example, make a list before you go shopping and stick to the list.

Also, when you see a product that attracts you, ask yourself if you really need it and whether you will take advantage of it.

9. Cancel Any Unused Subscriptions

Many companies make most of their money from subscriptions. Why?

Because once people sign up for them, the thought of canceling seems too tiring. In reality, canceling an unused subscription is even more than easy, and can save you a lot of money.

At first glance, it seems to you that unused subscriptions don’t take away much money, but when you “put it all on paper”, you will realize how much money you are wasting for nothing.

So, isn’t it better to save that money?

10. Reduce Your Phone Bill

Reducing your phone bill each month can quickly lead to big savings.

The same goes for buying a new mobile phone. Before buying the latest mobile phone model, ask yourself if it is worth buying a new phone if your existing one is still working well.

11. Try to Save Money on Utility Bills

Reducing utility bills each month can free up a considerable amount of money that you can set aside for saving.

12. Take Advantage of Discounts and Promotions

One of the most effective ways to save money is to take advantage of discounts and promotions when you go shopping. No matter what you want to buy, if there is a discount or promotion, take advantage of it.

Also, no matter how much money you have, set aside for savings.