In today’s fast-paced and ever-changing world, Gen Z finds itself navigating a unique set of financial challenges that their grandparents could never have imagined. From the rapid evolution of technology to the shifting job market and rising education costs, these young individuals face hurdles that require adaptability and resilience.

Unlike previous generations who enjoyed stable careers and affordable education, Gen Z must grapple with economic uncertainty and the pressures of a digital economy. Despite these challenges, they are finding innovative ways to manage their finances and secure their futures. Let’s explore twelve distinct money challenges that Gen Z faces today.

1. High Student Loan Debt

The burden of student loan debt is a significant challenge for Gen Z. Many start their careers already owing tens of thousands of dollars. This financial strain affects their ability to save for the future. It limits their career choices, often forcing them to take jobs primarily to pay off debt. With high-interest rates, the debt can grow over time, adding to the stress. Managing this debt requires careful planning and budgeting, and it may take years before they can fully focus on other financial goals. It’s not just a financial burden but an emotional one as well.

2. Gig Economy Instability

Gen Z frequently turns to gig work for flexibility and quick income. However, this path lacks the stability and benefits of traditional jobs. Without consistent pay, budgeting becomes challenging. There are no health benefits or retirement plans, adding to financial insecurity. For many, gig work is a stepping stone, but it requires juggling multiple jobs. This can lead to burnout, affecting their overall well-being. Despite the challenges, some see it as an opportunity to explore diverse interests and build a varied skill set. Balancing this instability with long-term financial planning is essential.

3. Rising Cost of Living

With housing costs soaring, many Gen Z individuals find it difficult to afford rent, let alone buy a home. Urban areas, where job opportunities are abundant, are particularly expensive. This financial strain often leads to living with roommates or family. Saving for a down payment becomes an elusive goal. Beyond housing, everyday expenses like groceries and transportation add to the burden. The rising cost of living requires careful budgeting and sometimes, tough choices. Despite these hurdles, many are finding creative ways to cut costs and still enjoy their youth, embracing minimalism and shared living spaces.

4. Digital Financial Literacy Gaps

Growing up in a digital age doesn’t guarantee financial literacy. Many Gen Z individuals lack a deep understanding of personal finance. This can lead to poor financial decisions, especially in managing credit and investments. Online resources are abundant, yet the complexity can be overwhelming. Without proper guidance, they may fall prey to scams or high-interest loans. Financial education is crucial but often neglected in school curricula. Bridging this gap involves seeking reliable sources and possibly professional advice. Despite these gaps, some are taking proactive steps to educate themselves, using technology to their advantage.

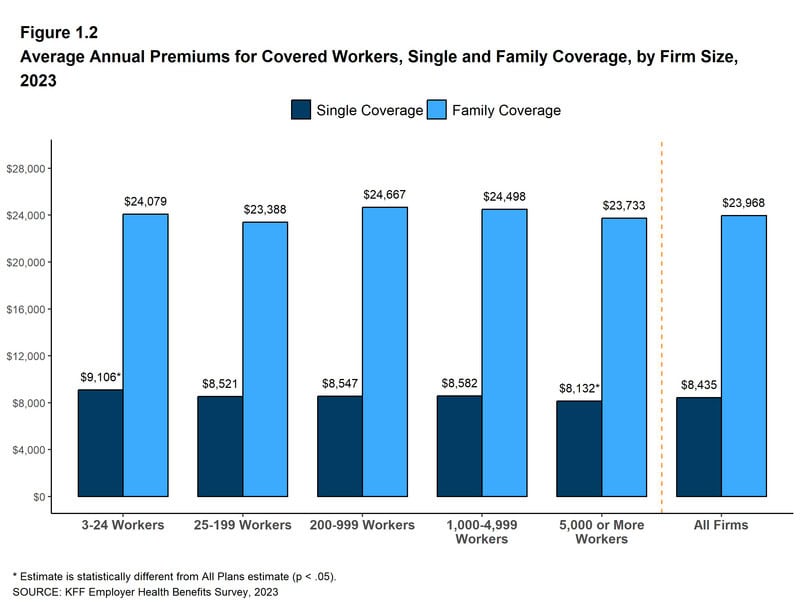

5. Health Insurance Costs

Navigating health insurance is a daunting task for many young adults. With rising costs, finding affordable coverage can be challenging. Many in Gen Z are self-employed or work gigs, lacking employer-provided benefits. This adds another layer of complexity to their financial planning. They must weigh the costs against potential medical needs. For some, this means opting for minimal coverage or going uninsured, risking hefty medical bills. Understanding health insurance and finding affordable options requires diligent research. Despite these obstacles, there are resources and programs available to aid them in making informed decisions.

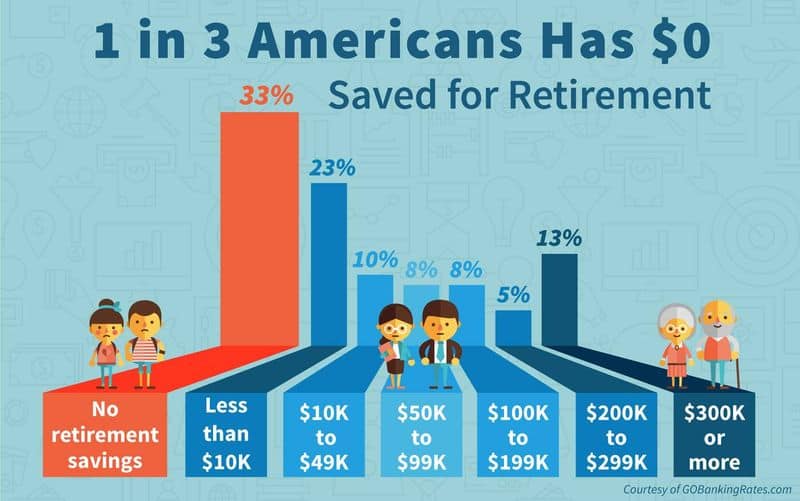

6. Lack of Retirement Savings

Long-term planning for retirement is often overshadowed by immediate financial concerns. Many in Gen Z postpone saving due to pressing student loans and living expenses. Without employer plans, like pensions or 401(k)s, saving becomes a personal responsibility. Some may underestimate the importance of starting early. The power of compound interest is significant, yet not always understood. Educating themselves about retirement savings options is key. Even small, consistent contributions can make a difference over time. Despite current challenges, planning for the future is crucial, and beginning early can lead to financial security in later years.

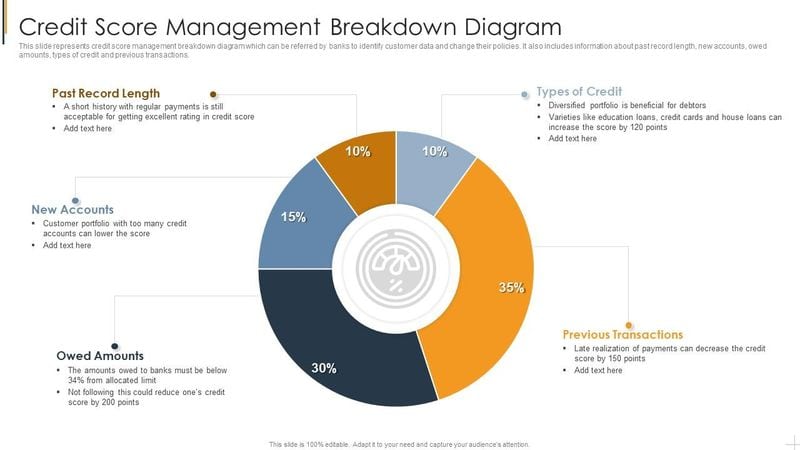

7. Credit Score Management

Building and maintaining a good credit score is essential but challenging. Gen Z often navigates this without prior experience or guidance. Missteps can lead to poor scores, impacting future financial opportunities. Managing credit involves timely payments and understanding credit limits. It’s about balancing use without falling into debt. Educating themselves about credit scores and their impact is crucial. Mistakes can take years to rectify. Despite these hurdles, many are leveraging tools and apps to monitor and improve their scores. This focus on credit health will benefit them immensely in the long run.

8. Impact of Social Media Spending

Social media’s influence on spending habits cannot be underestimated. For Gen Z, constant exposure to influencer lifestyles can lead to impulsive buying. The desire to keep up with trends adds to financial stress. Balancing the pressure to spend with the need to save requires discipline. Many find themselves in debt due to this spending culture. Recognizing these triggers is the first step. Mindful consumption and budgeting apps can help counteract impulsive buying. Despite these challenges, some are finding ways to enjoy social media while maintaining financial prudence, prioritizing needs over wants.

9. Economic Uncertainty

Economic volatility contributes to financial stress among Gen Z. With a global economy that’s unpredictable, job security is a concern. Economic downturns lead to unemployment or reduced income, affecting their ability to meet financial commitments. Planning for such uncertainties is crucial. Building an emergency fund can provide a safety net. It’s about balancing current expenses with future security. Despite these challenges, they are learning to adapt, focusing on skills that offer versatility in different economic climates. This adaptability is their strength in navigating uncertain times, ensuring they remain financially resilient.

10. Limited Financial Guidance

The lack of financial advice is a significant challenge for many in Gen Z. Without guidance, navigating complex financial landscapes is tough. Traditional advice may not always apply to their unique circumstances. Accessing personalized financial guidance requires effort and resources. Many turn to online forums or social media for advice, which can be unreliable. Professional advice is often expensive. Despite these obstacles, some are seeking mentors or using fintech tools to gain insights. Networking and learning from peers also offer valuable guidance. In this digital age, finding trustworthy advice is a crucial step towards financial empowerment.

11. Pressure to Achieve Early Success

There’s immense pressure on Gen Z to achieve financial success early. Influenced by social media, the race to ‘make it’ adds stress. This pressure can lead to burnout or risky financial choices. Balancing ambition with well-being is vital. Success looks different for everyone, and recognizing personal goals is crucial. It’s about finding a sustainable path that aligns with one’s values. Many are redefining what success means, focusing on personal growth rather than societal expectations. Despite these pressures, embracing a balanced approach to career and financial goals leads to long-term well-being and fulfillment.

12. Environmental and Ethical Spending

Environmental consciousness influences Gen Z’s spending habits. Many prioritize ethical and sustainable choices, even if they come at a higher cost. This commitment can strain budgets, requiring careful planning. Choosing products that align with values means supporting businesses that practice sustainability. Balancing ethical choices with financial constraints is challenging. It’s about making informed decisions that reflect personal beliefs. Despite the higher costs, this generation is passionate about making a positive impact. Embracing sustainable practices not only benefits the planet but also fosters a sense of purpose and alignment with personal values.

Well, hello there!

My name is Jennifer. Besides being an orthodontist, I am a mother to 3 playful boys. In this motherhood journey, I can say I will never know everything. That’s why I always strive to read a lot, and that’s why I started writing about all the smithereens I came across so that you can have everything in one place! Enjoy and stay positive; you’ve got this!