As Baby Boomers transition into retirement, many find that their savings are being eroded by a myriad of expenses. These costs, often underestimated, can significantly impact their financial security and quality of life. Here’s a detailed look into 12 common expenses that are chipping away at the savings of Boomers, along with some compelling insights.

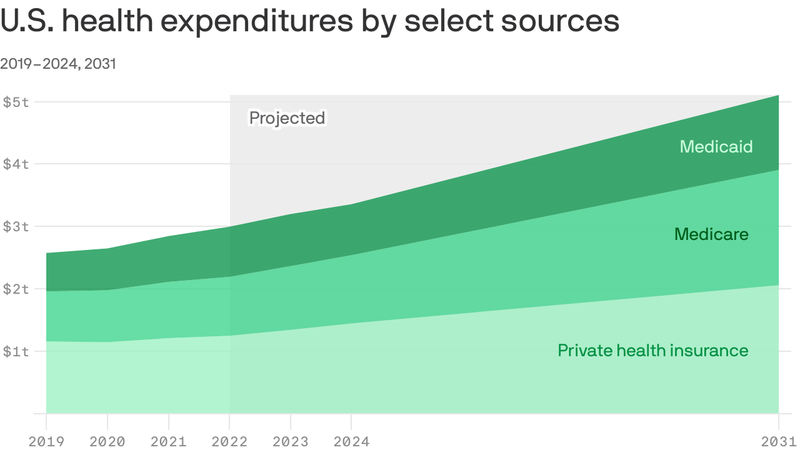

1. Healthcare Costs

Healthcare is a major financial burden for many Boomers. With age, medical needs increase, leading to higher expenses. Insurance premiums, out-of-pocket costs for medications, and unexpected medical emergencies can quickly add up.

Even with Medicare, there are gaps in coverage that require supplemental insurance. These additional policies, while essential, further strain finances.

Consider the cost of long-term care, which isn’t fully covered by regular insurance. Planning for these expenses is crucial, yet many are caught off guard by the high costs. Healthcare eats away at savings faster than anticipated.

2. Mortgage Payments

Many Boomers still find themselves paying off mortgages. The dream of retiring debt-free is elusive for those who bought homes later in life or remortgaged.

The financial pressure of monthly payments can be daunting. Some consider downsizing, but emotional ties to their family homes make this decision tough.

Interest rates also play a role, especially for those with adjustable-rate mortgages. Keeping up with these payments can drastically reduce retirement funds. Mortgage payments are a persistent expense that many didn’t foresee lasting into retirement years.

3. Credit Card Debt

Credit card debt is an unexpected drain on savings. Many Boomers use credit cards for everyday expenses, accumulating debt over time.

Interest rates can be exorbitant, turning small balances into large financial burdens. The ease of using credit cards masks the accruing debt.

Some Boomers struggle to make minimum payments, leading to a cycle of debt that’s hard to escape. To prevent savings erosion, managing and reducing credit card debt is essential for financial stability.

4. Assisting Family

Helping family financially can be a significant expense. Boomers often support adult children or even grandchildren.

This assistance might include covering education costs, helping with rent, or providing financial gifts. Such generosity, while rewarding, can put a strain on their resources.

The desire to help can outweigh financial prudence, leading to depleted savings. It’s important for Boomers to balance their willingness to assist with their financial capabilities.

5. Travel and Leisure

Travel is a cherished activity for many Boomers, but it can be costly. Retirees often dream of seeing the world, yet frequent trips can quickly drain savings.

Luxury accommodations, dining, and leisure activities add to the expenses. For some, the lure of travel overshadows the reality of its financial impact.

Planning travel within a budget can help mitigate these costs. Boomers should ensure their travel dreams don’t jeopardize their financial security.

6. Home Maintenance

Homeownership comes with ongoing maintenance costs that can eat away at savings. Aging properties require more frequent repairs, which can be unexpectedly expensive.

From roof replacements to plumbing issues, these expenses are often unavoidable. Many Boomers prefer to maintain their homes rather than move, despite the costs.

Regular upkeep is essential, but it’s crucial to budget for these expenses adequately. Home maintenance, though necessary, can be a financial burden.

7. Auto Expenses

Owning a car involves more than just fuel costs. Maintenance, insurance, and unexpected repairs can significantly impact savings.

As vehicles age, the frequency of repairs increases, often catching Boomers off guard. Reliable transportation is crucial, yet the associated costs can be draining.

It’s important to budget for automobile expenses and consider downsizing or transitioning to more cost-effective transportation options.

8. Insurance Premiums

Insurance is a necessary expense, yet premiums can be a financial thorn. Boomers often juggle multiple policies, including health, home, and auto insurance.

Premiums tend to rise with age, increasing financial strain. Even with careful planning, these costs can surprise.

Reviewing and adjusting coverage periodically can help manage expenses, but the reality is that insurance is an unavoidable financial commitment.

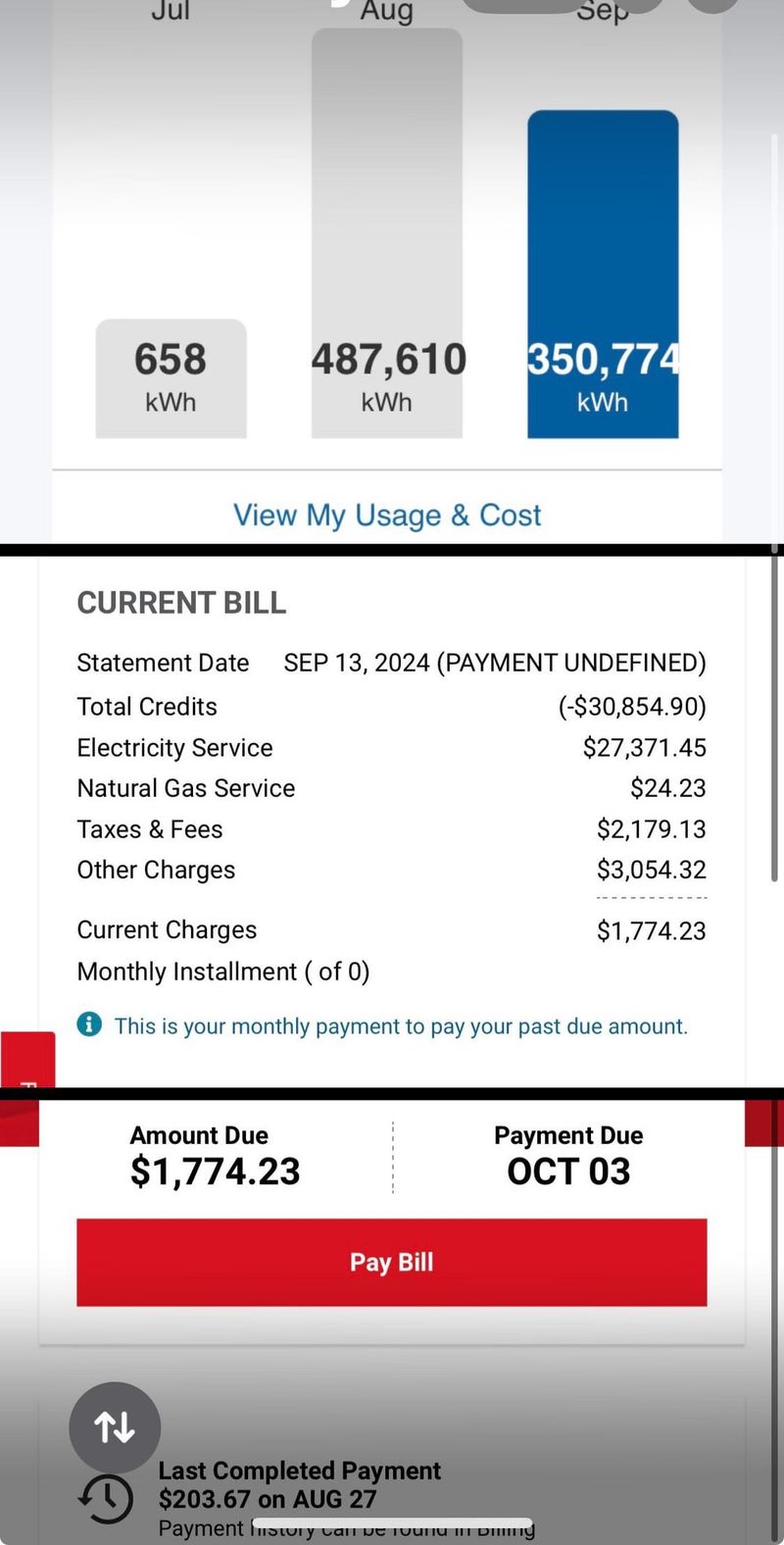

9. Utility Bills

Utility bills may seem minor, yet they accumulate significantly over time. With energy prices fluctuating, Boomers often face higher costs, especially during extreme weather.

Heating, cooling, and electricity usage can add up quickly, impacting their budget. Many retirees find it challenging to manage these expenses without affecting their lifestyle.

Adopting energy-efficient practices and technologies can help reduce costs, but utility bills remain a persistent financial pressure.

10. Medical Equipment

As health needs change, so does the requirement for medical equipment. Items like walkers, oxygen tanks, or specialized beds are common among Boomers.

These necessities, while improving quality of life, can be expensive. Often, insurance doesn’t fully cover the cost, leaving Boomers to pay out-of-pocket.

Planning for these expenses is essential, though many find themselves unprepared for the high costs of necessary medical devices.

11. Subscriptions and Memberships

Subscriptions can quietly drain savings. Boomers often subscribe to multiple services, such as streaming, magazines, or clubs.

These recurring expenses, though individually small, can add up over time. It’s easy to overlook these costs, yet they contribute to financial strain.

Regularly reviewing and canceling unnecessary subscriptions can aid in financial management. Monitoring these expenses ensures they don’t erode savings unexpectedly.

12. Inflation Impact

Inflation is a silent adversary to savings. As the cost of living rises, the purchasing power of Boomers’ savings diminishes.

Everyday expenses, from groceries to healthcare, become more costly, squeezing budgets tighter. Many Boomers find it challenging to adjust their spending accordingly.

Investing in inflation-protected securities and monitoring expenditure can mitigate some effects, but inflation remains a persistent challenge.