Retirement is a time many look forward to, a period when they can finally relax and enjoy the fruits of their labor. However, for Baby Boomers, this new phase can sometimes lead to unexpected spending habits that may not always be practical. As retirees, the temptation to indulge and splurge on various luxuries or conveniences is ever-present.

Understanding where these expenses may arise can help in better managing finances during this crucial stage of life. In this article, we’ll explore 15 common areas where Baby Boomers often find themselves spending more than necessary, providing insights and tips on how to avoid these financial pitfalls.

1. Expensive Cruises

Cruises offer a convenient way to see the world, but they can quickly become money pits. Many retirees feel the allure of all-inclusive packages, forgetting that additional expenses like excursions and specialty dining can add up. It’s easy to overspend on luxury options, seeking comfort and convenience. Retirees often justify these trips as a reward for years of hard work, but regular cruises can strain retirement savings. Consider budget-friendly alternatives or occasional splurges to keep finances on track. Prioritizing experiences over material extravagance can make travel both enjoyable and sustainable.

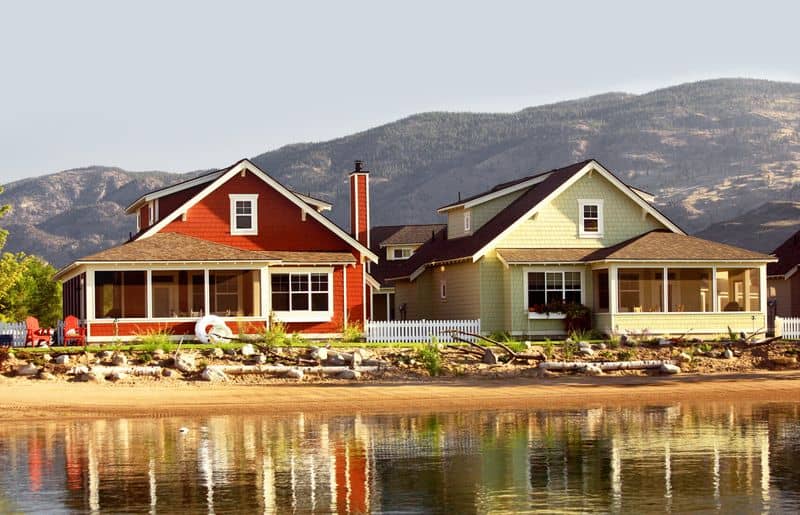

2. Second Homes

Owning a second home in a dream location is appealing but costly. Property taxes, maintenance, and utilities can quickly drain retirement funds. Many spend on homes that sit empty for most of the year. Renting or using holiday rentals can provide similar experiences without the financial burden. Additionally, timeshare options, though tempting, often come with hidden fees. Retirees should evaluate how often they’ll use a second home before purchasing. Financial flexibility can be better maintained by exploring diverse vacation options rather than tying money into a single property.

3. Luxury Cars

After a lifetime of work, driving a luxury car seems like a fitting reward. However, such vehicles come with high costs not just in purchase but also in maintenance and insurance. Retirees often overlook these ongoing expenses, which can strain their fixed income. Opting for a reliable, fuel-efficient vehicle can save money while providing comfort. It’s worth remembering that a car’s purpose is primarily functional; luxury features, though nice, often don’t justify the extra expense. Evaluating needs versus wants can help retirees make wiser automotive choices.

4. Fine Dining

Dining out at upscale restaurants offers a delightful experience but can significantly impact finances. Many retirees enjoy the social aspect and quality of fine dining but overlook how quickly costs add up. Cooking at home is an enjoyable, healthier, and more affordable alternative. Experimenting with new recipes can become a hobby. Dining out occasionally keeps it special. Watching for deals or early-bird specials can also reduce costs. Balancing between the joy of eating out and practical financial management is key to maintaining a comfortable lifestyle in retirement.

5. Antique Collections

Collecting antiques can be a fascinating hobby, yet it often involves significant expense. Retirees may find themselves investing in rare items that seem valuable but might not appreciate over time. The allure of building a collection can lead to impulsive purchases. It’s crucial to research and invest wisely, focusing on pieces that genuinely hold or increase value. Downsizing and selling less-loved items can also help balance the collection with financial stability. A thoughtful approach to collecting can ensure it remains a satisfying rather than financially draining pursuit.

6. Timeshares

Timeshares promise affordable vacations but entail long-term commitments and hidden fees. Many retirees are swayed by the idea of a guaranteed holiday spot, only to find costs accumulate. Maintenance fees and inflexible schedules can turn this dream into a burden. Exploring vacation rentals or travel clubs might offer more flexibility. Selling a timeshare can be challenging, often at a loss. Understanding the financial implications and considering alternatives before investing in a timeshare is essential. Budget-friendly travel options can provide diverse experiences without the financial constraints of ownership.

7. Golf Club Memberships

Joining a prestigious golf club is an enticing prospect for many retirees, but it comes with hefty membership fees and ongoing costs. While the social and health benefits are attractive, they must be weighed against financial implications. It’s easy to overlook how quickly these expenses add up, especially if usage is infrequent. Exploring public courses or pay-as-you-go options can provide similar enjoyment without the financial commitment. Prioritizing budget-friendly recreation ensures that relaxation doesn’t lead to financial strain. Retirees should assess how much they truly will play before signing up.

8. High-End Electronics

Keeping up with the latest technology can be enticing but costly. Retirees often splurge on high-end electronics, seeking entertainment or communication conveniences. However, frequent upgrades and purchases can deplete savings. Consider the functional needs versus the allure of cutting-edge features. Often, more affordable models meet daily requirements without the extra expense. Assessing technology purchases carefully ensures they align with both lifestyle and financial goals. Embracing a mindset of practicality over novelty can help maintain financial health while still enjoying modern conveniences.

9. Hobbies and Craft Supplies

Engaging in hobbies is a fulfilling way to spend retirement, but costs can escalate. Many retirees invest in craft supplies, tools, or materials without considering the financial impact. Bulk buying during sales can mitigate some costs. Exploring community centers for shared resources or workshops can also provide cost-effective options. Setting a budget and planning purchases helps keep this passion sustainable. Prioritizing what’s truly needed over impulsive buying ensures hobbies remain enjoyable without financial worry. Embracing creativity doesn’t have to mean compromising financial security.

10. Home Renovations

Home improvements are appealing to enhance comfort, yet they can become costly. Retirees may undertake renovations without fully evaluating the budget implications. It’s important to differentiate between necessary upgrades and aesthetic desires. Seeking multiple quotes and considering DIY options can help control expenses. Renovation projects are best approached with a clear plan and budget to avoid overspending. Balancing comfort with cost-effectiveness ensures that home enhancements contribute positively to retirement living. Thoughtful planning helps ensure that the enjoyment of renovations doesn’t lead to financial stress.

11. Family Gifts and Loans

Generosity towards family is a cherished value, yet it can strain finances in retirement. Many retirees feel compelled to support children or grandchildren, either through gifts or loans. These gestures, if frequent and unplanned, can disrupt financial stability. Clear communication and setting boundaries can help manage expectations. Encouraging financial independence in younger family members benefits everyone. Thoughtful gifting, such as experiences over money, can maintain generosity without harming financial well-being. Retirees should prioritize their financial health, ensuring they remain secure while still expressing their love.

12. Pet Pampering

Pets bring joy and companionship, prompting retirees to splurge on their needs. High-end pet products, frequent grooming, and luxury services add up quickly. It’s important to balance pampering with practicality. Regular vet visits and quality food are essential, but luxury items can often be unnecessary. Exploring cost-effective care options helps maintain a budget-friendly approach. Retirees should focus on what truly benefits their pets’ health and happiness. Practical pet care ensures that the companionship of furry friends remains a source of joy rather than financial worry.

13. Subscription Services

The convenience of subscription services appeals to retirees seeking ease, but costs can accumulate. From streaming platforms to meal kits, these recurring expenses may go unnoticed. Reviewing subscriptions regularly and assessing their value is essential. Downgrading plans or canceling unused services helps manage expenses. Bundling services or seeking discounts can also provide savings. Retirees should evaluate what truly enhances their lifestyle versus what’s become routine. Conscious management of subscriptions ensures that they continue to offer value without eroding financial security.

14. Travel Clubs

Joining travel clubs offers appealing discounts but often involves fees and restrictions. Retirees should carefully evaluate membership benefits against costs. Many find that the promised savings are overshadowed by limitations and blackout dates. Exploring alternative travel planning methods, such as online deals or loyalty programs, can offer similar advantages. Retirees should ensure that travel remains enjoyable and affordable without the constraints of club commitments. A flexible approach to travel planning ensures that adventures don’t come at the expense of financial stability.

15. Cosmetic Procedures

The desire to look youthful leads many retirees to consider cosmetic procedures. While these can boost confidence, they’re often expensive and require ongoing maintenance. Understanding the full cost, including follow-ups, is crucial. Non-surgical alternatives or embracing natural aging can be more sustainable choices. Cosmetic enhancements should align with both personal goals and budget realities. Retirees must weigh the benefits against financial implications. Prioritizing well-being and self-acceptance over aesthetic desires can ensure that financial resources are used wisely, supporting a joyful and secure retirement.

16. High-End Fitness Equipment

Staying active is essential for retirees, but splurging on expensive fitness equipment can strain a budget. Many retirees invest in high-end treadmills, ellipticals, or home gyms, only to find that these items go unused or become burdensome to maintain. A more cost-effective approach is to focus on low-cost alternatives such as yoga mats, resistance bands, or bodyweight exercises. Community centers often offer affordable fitness classes, providing both social and physical benefits. Prioritizing functional fitness over flashy equipment ensures that health remains a focus without overspending.

Well, hello there!

My name is Jennifer. Besides being an orthodontist, I am a mother to 3 playful boys. In this motherhood journey, I can say I will never know everything. That’s why I always strive to read a lot, and that’s why I started writing about all the smithereens I came across so that you can have everything in one place! Enjoy and stay positive; you’ve got this!