Home insurance is a crucial part of protecting your most valuable asset, but misconceptions abound. Many homeowners operate under false assumptions about their coverage, potentially leaving them vulnerable when they most need protection. This blog post uncovers seven common misunderstandings that could cost you dearly. By dispelling these myths, you’ll be better equipped to secure comprehensive coverage that truly protects your home and finances.

1. Assumption 1: Flood Damage is Covered

Many homeowners believe their standard policy covers flood damage, but this is often not the case. Flood insurance usually requires a separate policy. Only about 15% of homes have flood insurance, leaving many exposed.

Floods can occur anywhere, not just near water bodies. Heavy rains or broken dams can cause unexpected flooding. Without the right coverage, repairing flood damage can be financially devastating.

Consider the potential costs of water damage versus the relatively low cost of additional coverage. Be proactive and evaluate your flood risk to ensure peace of mind.

2. Assumption 2: Market Value Equals Replacement Cost

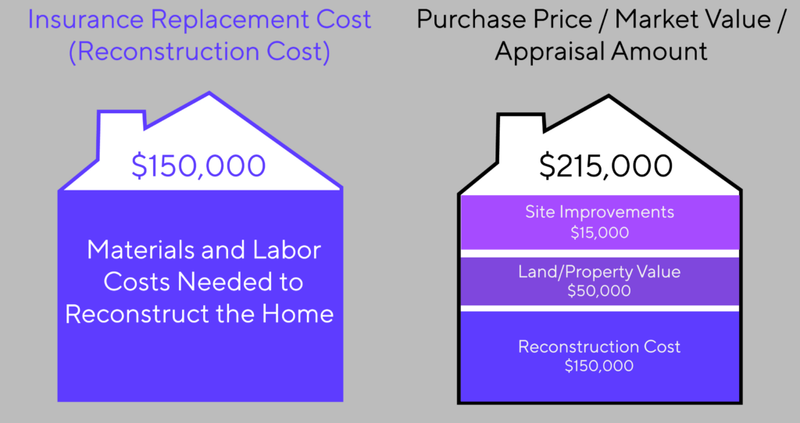

Homeowners often equate their property’s market value with its replacement cost. However, these are distinct concepts. Market value includes land value and local property trends, while replacement cost focuses on the expense to rebuild the home.

Market fluctuations can inflate or deflate values, causing misalignment with actual rebuilding costs. It’s important to insure based on rebuilding expenses, not real estate prices.

Consult with your agent to ensure your policy reflects true replacement costs, safeguarding you from unexpected expenses if disaster strikes.

3. Assumption 3: Personal Belongings are Fully Covered

Many assume their home insurance policy covers all personal belongings for their full value. However, policies often set limits on certain items, like jewelry or electronics.

Your grandmother’s heirloom necklace or high-end gadgets might not be fully covered without additional riders. Regularly updating your inventory and discussing itemized coverage with your insurer is wise.

Knowing the policy’s specifics helps avoid unpleasant surprises after a loss. Check and adjust your coverage regularly to ensure your cherished items are adequately protected.

4. Assumption 4: Renovations Automatically Update Coverage

Assuming renovations automatically adjust your coverage is risky. Upgrades, like a new kitchen or bathroom, can significantly increase your home’s value, but insurers need to know about these improvements.

Failing to update your policy can leave you underinsured, unable to recover full costs if a claim is made. Proactively updating your insurer about renovations ensures your coverage matches your home’s new value.

Regular communication with your insurance provider helps maintain appropriate coverage, reflecting any changes in your property’s value.

5. Assumption 5: Home Business is Covered by Standard Policy

A growing number of people run businesses from home, assuming their homeowner’s policy covers professional activities. Unfortunately, many standard policies exclude business-related claims, requiring separate coverage.

An office fire could lead to significant losses if not properly insured. Verify what your policy covers and consider business insurance for more comprehensive protection.

Discuss your specific business needs with an agent to avoid costly surprises. Adding tailored coverage ensures your home business is as secure as your personal property.

6. Assumption 6: Tree Damage is Always Covered

The assumption that tree damage is universally covered can lead to complications. Coverage often depends on the tree’s condition and the cause of the fall.

Healthy trees that fall due to a covered peril, like a storm, are typically covered. However, negligence or poor maintenance might void coverage. Regular inspections and maintenance are key to avoiding disputes and ensuring claims are honored.

Know the specifics of your policy and maintain your trees to minimize risk and ensure coverage when nature runs amok.

7. Assumption 7: Liability Coverage is Sufficient

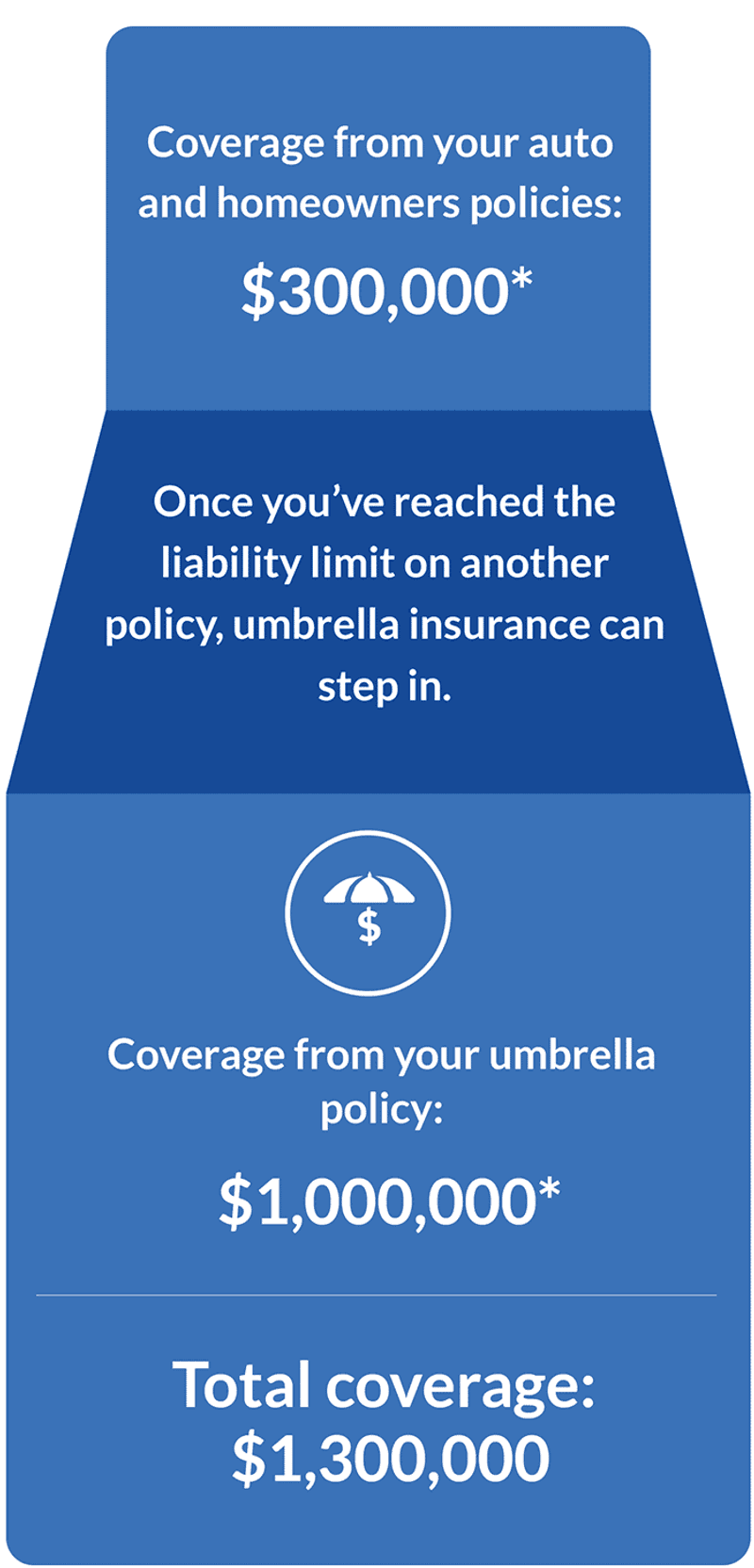

Homeowners often trust their liability coverage to handle all mishaps, but it may not be enough. Standard policies usually cover up to $300,000, insufficient for serious incidents.

Consider an umbrella policy for added protection, especially if you have risky features like a pool. Such coverage extends beyond standard limits, offering additional financial security.

Evaluate your lifestyle and potential liabilities to determine if additional coverage is necessary. Protect your assets by ensuring your liability coverage matches your risk profile.

Hi all, I am Sidney, an accountant, a hobbyist photographer, and a mother to two sweet girls who are my motivation. I love sharing the tips and tricks I gained all these years I’ve been a mother. I hope it will help you!