Retirement is a time to enjoy the fruits of your labor, but without careful financial management, it’s easy to deplete your savings prematurely. Here are several common pitfalls retirees should avoid:

1. Overspending on Vehicles

Luxury cars often lure retirees with their allure and status. These vehicles come with hefty price tags and even greater hidden costs. Insurance premiums can skyrocket, and maintenance fees can eat away at savings. A car’s rapid depreciation is another factor to consider. Retirees should ask themselves if the joy of a luxury car outweighs the financial burden it imposes. Opting for a modest, reliable vehicle might be a wiser choice for those looking to stretch their retirement funds. Consider the roads less traveled, where practicality meets comfort without breaking the bank. Sometimes, less truly is more.

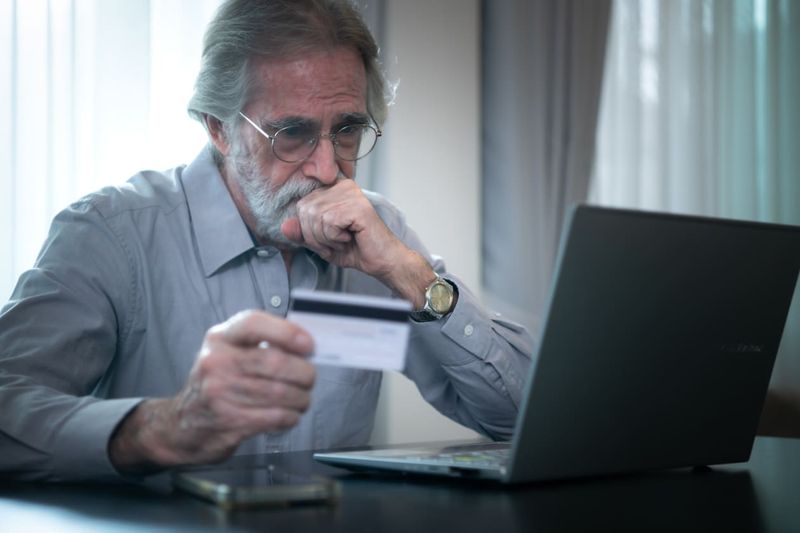

2. Falling Victim to Scams

Scammers often target retirees, seeing them as easy prey due to accumulated assets and possible unfamiliarity with technology. These fraudsters use sophisticated tactics to deceive and steal. Protecting one’s savings requires vigilance and awareness. Retirees should stay informed about common scams and take necessary precautions. Engaging with trusted family or financial advisors can also help. Being cautious and skeptical of unsolicited offers is a good practice. Remember, if something seems too good to be true, it probably is. Staying educated is the best defense against these financial predators.

3. Ignoring Senior Discounts

Senior discounts are more than just small perks; they can lead to significant savings over time. Many businesses, from restaurants to retail stores, offer reduced rates for seniors. Ignoring these discounts is like leaving money on the table. Retirees should actively seek out these opportunities and enjoy the benefits they bring. It’s a simple way to make every dollar count. By using these discounts regularly, savings can accumulate, adding more room for leisure activities or unexpected expenses. Don’t shy away from asking about available discounts wherever you go—it could be a delightful surprise.

4. Not Focusing on Health

Health is wealth, especially in retirement. Ignoring it can lead to soaring healthcare costs. Preventive care, regular check-ups, and maintaining a healthy lifestyle should be priorities. Investing in health now can save money and enhance quality of life later. Exercise, balanced nutrition, and mental wellness are crucial. Retirees should strive to incorporate these into their daily routines. Small steps, like a morning walk or a balanced meal, can make a big difference. Embracing wellness is a rewarding way to safeguard both health and finances. Prioritizing well-being today ensures a vibrant tomorrow.

5. Remodeling Homes Unnecessarily

Home is where the heart is, but unnecessary renovations can turn it into a financial burden. Retirees might feel tempted to make lavish upgrades without considering the costs. Such projects can drain savings, especially if funded through early withdrawals. It’s wise to evaluate whether changes truly enhance living conditions. Sometimes, simple updates can refresh a space without breaking the bank. Avoid being swayed by trends that may not add value in the long run. Retirees should focus on practicality and comfort, ensuring their home remains a haven without financial strain.

6. Supporting Adult Children Financially

Love and support for family are natural, but financially aiding adult children can strain retirement savings. Setting boundaries is crucial. Encouraging financial independence in children benefits both parties. Retirees should assess the impact of continued support on their funds. It’s important to strike a balance between helping and preserving one’s financial well-being. Open conversations about finances can foster understanding and responsibility. Retirees must ensure their comfort and security first. Generosity is admirable, but it should not come at the expense of one’s future. Financial health is a legacy in itself.

7. Carrying Credit Card Debt

Credit card debt is a silent financial enemy that can haunt retirees. Living within monthly income limits is crucial to avoid this pitfall. Interest rates on unpaid balances can quickly accumulate, creating a snowball effect. Prudent financial planning involves budgeting, monitoring expenses, and prioritizing debt repayment. Retirees should focus on clearing outstanding debts before indulging in discretionary spending. It’s wise to use credit cards for necessities only and pay off balances promptly. Maintaining a debt-free lifestyle brings peace of mind and financial freedom. This approach ensures a more secure and carefree retirement.

8. Owning Multiple Cars

Two cars may seem convenient, but the costs double. Insurance, maintenance, and fuel expenses can quickly add up. Downsizing to a single vehicle can lead to substantial savings. Retirees should evaluate their transportation needs and consider practicality over luxury. Carpooling with friends or using public transport are viable alternatives. Sometimes, the freedom of fewer responsibilities outweighs the convenience of multiple vehicles. Being open to change can lead to more financial flexibility. Simplifying life often brings unexpected relief and joy. The road to savings may well be traveled in a single car.

9. Shopping as a Hobby

Retail therapy can be costly. For retirees, shopping as a hobby might lead to unnecessary spending. Developing diverse interests can offer more fulfilling and economical pastimes. Engaging in community events, learning new skills, or volunteering are enriching alternatives. Consider turning shopping trips into social outings without the pressure to purchase. Retirees can explore window shopping as a contemplative activity. Reflecting on needs versus wants helps curb impulse buys. By focusing on experiences rather than possessions, retirees can nurture joy and savings alike. Embracing creativity enriches life beyond material pursuits.

10. Making Risky Investments

Navigating investments in retirement demands prudence. High-risk ventures can lead to significant losses. Retirees should focus on capital preservation and align investments with risk tolerance. Engaging with financial advisors can provide clarity and guidance. Balancing the portfolio towards safer options reduces anxiety and ensures steady growth. It’s essential to keep emotions in check and avoid impulsive decisions. Retirees should remember that peace of mind often outweighs potential high returns. A diversified, cautious approach secures a stable future. Financial wisdom lies in knowing when to hold and when to fold.

11. Not Downsizing

A larger home may hold cherished memories, but it can also mean higher expenses. Retirees should weigh the benefits of downsizing. Reducing living space can lower utility bills, taxes, and maintenance costs. Moving to a comfortable, smaller home frees up funds for other pursuits. It’s a chance to rethink priorities and embrace a lifestyle with fewer burdens. Emphasizing quality over quantity brings more freedom and peace. Downsizing is not just about space; it’s about creating a life that aligns with current needs. Retirees can find joy in simplicity and financial ease.

12. Overlooking Tax Implications

Taxes can be an unexpected burden if not planned for. Retirees need to be proactive in understanding tax liabilities. Missteps can lead to reduced funds available for spending. Consulting with tax professionals can offer insights into efficient tax strategies. Awareness of deductions and credits available to seniors can maximize savings. It’s crucial to integrate tax planning into overall financial management. Retirees should aim to keep more money in their pockets by minimizing tax exposure. Proper tax planning ensures a worry-free financial journey. Every dollar saved strengthens financial security in retirement.

13. Not Reviewing Investment Portfolios

Set-and-forget strategies might seem convenient, but retirees must adapt to changing circumstances. Regularly reviewing investment portfolios ensures alignment with financial goals. Market shifts demand attention and possible reallocation of assets. Retirees should engage with financial advisors to fine-tune investment strategies. This proactive approach can prevent unwanted surprises and losses. Financial landscapes evolve, and so should investment tactics. Retirees who actively manage their portfolios can better safeguard their savings. Staying informed and flexible is key to navigating retirement finances. A well-adjusted portfolio supports resilience and peace of mind.

14. Not Differentiating Between Wants and Needs

Understanding wants versus needs is essential for prudent spending. Retirees should reflect before making purchases, especially larger ones. Analyzing whether an item serves a genuine need prevents impulse buying. This mindfulness helps manage retirement funds more effectively. It’s wise to prioritize essentials and limit discretionary spending. Retirees can create budgets that reflect these distinctions, reinforcing financial discipline. Thoughtful spending ensures savings last longer, providing stability and confidence. Financial wisdom involves asking, “Do I need this, or do I just want it?” Clarity in spending choices supports a secure future.

15. Overindulging in Generosity

Generosity warms the heart, but unchecked, it can cool the bank account. Retirees often wish to give back, yet setting limits is vital. Establishing a budget for charitable contributions ensures thoughtful giving. Retirees can explore non-monetary ways to support causes, such as volunteering. Balancing generosity with personal financial health is key. It’s important to feel good about giving without jeopardizing one’s savings. Retirees should focus on sustainable ways to contribute. Financial health allows continued support for loved ones or charities. Thoughtful generosity reflects caring while protecting future security.

16. Owning Multiple Homes

Owning multiple homes might seem luxurious, but the costs can be overwhelming. Maintenance, property taxes, and insurance multiply, stretching retirement funds thin. Selling a second home can free up significant financial resources. Retirees should consider their actual needs versus perceived wealth. Simplifying life by maintaining a single residence can offer both peace of mind and financial balance. This decision often opens doors to new experiences and lessens burdens. By focusing on one home, retirees can allocate more resources to travel or hobbies. Embracing simplicity nurtures freedom and contentment.

17. Collecting Social Security Too Early

Timing is everything when it comes to Social Security. Claiming benefits too early can reduce payments permanently. Retirees should weigh the benefits of waiting until full retirement age or even later. Delayed claims increase monthly income, enhancing long-term financial stability. It’s a strategic move, providing more substantial support over time. Retirees need to plan carefully, considering life expectancy and financial needs. Consulting with financial experts can clarify the best approach. Patience pays off, turning time into a financial ally. Wise timing ensures a more rewarding retirement journey.

Well, hello there!

My name is Jennifer. Besides being an orthodontist, I am a mother to 3 playful boys. In this motherhood journey, I can say I will never know everything. That’s why I always strive to read a lot, and that’s why I started writing about all the smithereens I came across so that you can have everything in one place! Enjoy and stay positive; you’ve got this!