For many millennials, the financial landscape looks entirely different from the one their parents navigated. The economic conditions that allowed boomers to enjoy certain luxuries are now scarce. From affordable housing to financial stability, boomers had access to opportunities that seem out of reach for today’s younger generations.

This list explores the twelve key aspects of life that boomers could afford without much hassle, but which now seem like distant dreams for millennials. Though times have changed, it’s intriguing to reflect on how different life was just a few decades ago.

1. Affordable Housing

Boomers often talk about buying their first homes for just a few thousand dollars. In the past, housing was affordable, with prices that seemed reasonable compared to the average income. Today, millennials face staggering real estate prices that have skyrocketed beyond reach. The financial burden of purchasing a home now requires saving for decades or settling for smaller spaces. Affordable housing, once a norm, has turned into a luxury. Many millennials opt for renting instead, as ownership becomes increasingly unattainable. The dream of a spacious home with a backyard is fading.

2. Generous Pensions

During the boomer era, generous pensions were a staple benefit offered by many employers. These pensions provided financial security in retirement, ensuring a stable income without the need for personal savings. Today, the landscape has shifted dramatically, with pensions replaced by less secure options like 401(k)s. Millennials now face the challenge of saving extensively on their own to ensure a comfortable retirement. The shift from employer-backed pensions to self-funded retirement plans marks a significant financial burden. This change requires millennials to start planning early and manage investments wisely.

3. Free College Education

In the past, many boomers enjoyed free or highly affordable college education, thanks to government funding and grants. This allowed them to graduate without the heavy burden of student loans. Today, millennials encounter a starkly different reality, with tuition fees soaring and student debt becoming a lifelong commitment. Higher education has transformed from a near-universal right to a privilege that requires careful financial planning. Millennials often graduate with significant debt, impacting their ability to save for other life goals. Affordable education remains a distant memory for many.

4. Job Stability

Boomers experienced an era of job stability, where long-term employment with a single company was common. This stability offered security and allowed for consistent career growth. Millennials, however, enter a job market characterized by gig economy roles, short-term contracts, and frequent job changes. The once-reliable path of climbing the corporate ladder is now less assured. This instability requires millennials to adapt quickly and continuously learn new skills. The shift from stable careers to flexible, uncertain employment has reshaped financial planning and career expectations for today’s working generation.

5. Affordable Healthcare

Boomers had access to more affordable healthcare systems, with lower premiums and comprehensive coverage. Today, millennials face skyrocketing healthcare costs, with insurance premiums and medical expenses consuming larger portions of their income. Many struggle to afford adequate health insurance, leading to a reliance on emergency care and out-of-pocket expenses. The once-accessible healthcare system now demands strategic financial planning. Finding affordable health coverage requires millennials to navigate complex insurance markets and weigh cost against coverage, often at the expense of preventative care and routine check-ups.

6. Cheap Travel

Boomers often reminisce about affordable travel opportunities, with low-cost flights and budget-friendly vacation packages. Travel was a common leisure activity, accessible to many without breaking the bank. Nowadays, millennials face higher travel costs, from airfare to accommodation, making frequent vacations a luxury. The rising cost of living has made saving for travel more challenging. Many millennials prioritize local experiences over international adventures. Exploring the world requires careful budgeting and strategic planning. The days of spontaneous, affordable getaways are becoming a rarity in today’s economic climate.

7. Low-Cost Childcare

In the past, affordable childcare was a given, allowing parents to balance work and family life without financial strain. Boomers benefited from community support and lower childcare costs, enabling full-time employment and career advancement. Today, affordable childcare is scarce, posing challenges for working millennials. High childcare expenses often force parents to make tough decisions between career and family. The lack of affordable options impacts career progression and financial stability. Many millennials rely on extended family or seek flexible work arrangements to manage childcare costs, a stark contrast to previous generations.

8. Interest-Free Education Loans

Boomers had access to interest-free or low-interest education loans, easing the financial burden of pursuing higher education. These loans were manageable, allowing graduates to focus on building careers without overwhelming debt. Today, millennials face high-interest student loans, leading to prolonged repayment periods. The pressure to repay educational debt affects life choices, from buying a home to starting a family. Managing student loan debt requires strategic budgeting and financial sacrifices. The transition from interest-free to high-interest loans has significantly altered the landscape of higher education financing.

9. Affordable Cars

Boomers often recall buying their first cars at affordable prices, with low maintenance costs and accessible financing. Cars were both a necessity and a symbol of freedom. For millennials, the cost of purchasing and maintaining a vehicle has increased significantly. Rising car prices, fuel costs, and insurance premiums make car ownership a substantial financial commitment. Many millennials opt for public transportation or car-sharing services to manage expenses. The days of easily accessible, budget-friendly cars are fading, replaced by a need for careful financial planning and alternative transportation solutions.

10. Affordable Vacations

Boomers fondly remember affordable family vacations, where travel did not strain the budget. These trips provided memorable experiences without financial stress. Millennials, however, encounter increased vacation costs, from transportation to accommodation, resulting in less frequent family getaways. The financial planning required for vacations now demands more savings and strategic decisions. Many millennials choose short trips or local destinations to cut costs. The simplicity of affordable vacations, where relaxation was prioritized over budget constraints, is something millennials often find challenging to replicate in today’s economic environment.

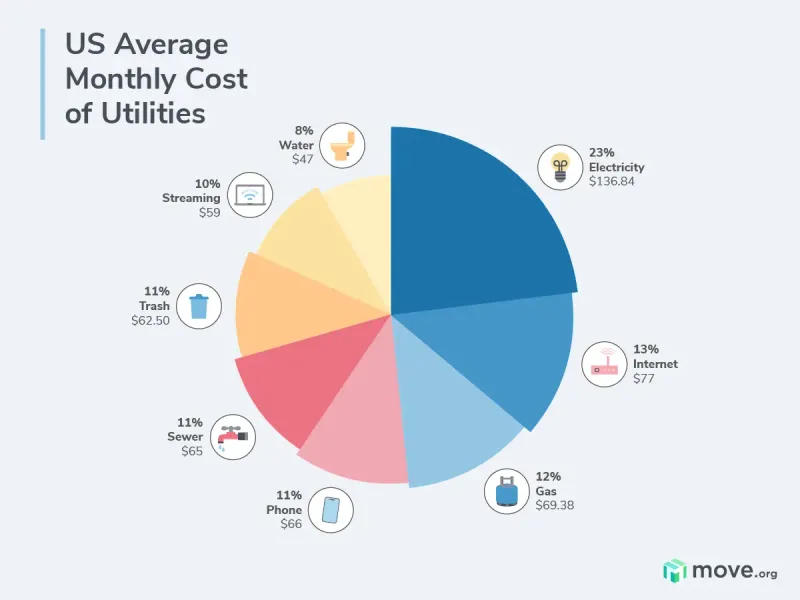

11. Reasonable Utility Bills

Boomers lived in an era where utility costs were reasonable, contributing to overall financial stability. Lower electricity, water, and heating costs allowed for manageable living expenses. Millennials face increasing utility bills, driven by rising energy prices and consumption demands. These escalating costs require strategic budgeting and energy-efficient home upgrades. The challenge of managing living expenses is compounded by unpredictable utility costs. Many millennials seek alternative energy sources or smart home technologies to reduce bills. The shift from reasonable to high utility costs marks a significant financial change over generations.

12. Accessible Social Security

Boomers could rely on robust social security systems, providing a safety net in retirement. This financial support allowed for a comfortable and secure post-work life. Today, millennials express concerns about the future of social security, facing uncertainty regarding its sustainability. The shift from a dependable to a potentially unstable system has altered retirement planning. Millennials must explore alternative savings options and investments to ensure financial security. The once-reliable social security is now a topic of concern, prompting proactive financial strategies to prepare for retirement.

Well, hello there!

My name is Jennifer. Besides being an orthodontist, I am a mother to 3 playful boys. In this motherhood journey, I can say I will never know everything. That’s why I always strive to read a lot, and that’s why I started writing about all the smithereens I came across so that you can have everything in one place! Enjoy and stay positive; you’ve got this!