Planning for the future is an essential part of life, especially when considering what you will leave behind for your children. While we often focus on the positive legacies we can pass on, it’s equally important to be mindful of the negative burdens that might unintentionally fall on their shoulders.

We’ll explore ten things you should never leave behind for your kids when you’re gone. These are the pitfalls, stresses, and unnecessary challenges that can complicate their lives. By addressing these issues now, you can ensure a smoother, more meaningful legacy for your family.

1. Unresolved Debts

Leaving unresolved debts can severely burden your children financially and emotionally. It’s crucial to address any outstanding obligations during your lifetime. Creating a clear financial plan helps manage your assets and liabilities effectively. Seek professional advice to settle debts and consider insurance options to cover unexpected expenses. By doing so, you prevent your children from facing unexpected financial stress. Discuss financial matters openly with your family, ensuring they understand your plans and obligations. This openness helps build trust and prepare them for the future. Avoid leaving your loved ones in a difficult financial situation.

2. Legal Disputes

Legal disputes can be a significant source of stress and conflict among your heirs. If you have ongoing legal battles, strive to resolve them promptly. Consider how your estate plan may be challenged and take steps to mitigate potential conflicts. This might involve updating your will or establishing clear legal documentation. Clear communication with family members about your wishes and expectations is key. Transparency helps in minimizing misunderstandings that could escalate into disputes. By addressing legal issues now, you ensure that your family can focus on healing rather than litigating after your passing.

3. Family Conflicts

Family conflicts are often left unresolved, passing emotional burdens to the next generation. Addressing these issues during your life can prevent future strife. Regular family meetings can foster open communication and understanding. Working with a family therapist may help resolve deeper issues. It’s essential to express your wishes clearly regarding family matters in your will or estate plan. Encourage a culture of forgiveness and understanding within your family. By tackling conflicts head-on, you reduce the risk of discord after your passing and promote a harmonious family environment.

4. Unorganized Estate

An unorganized estate can lead to confusion and disputes among your heirs. Organizing your estate involves creating a clear inventory of assets, liabilities, and important documents. Ensure your will is updated and reflects your current wishes. Consider consulting with an estate planner to streamline this process. Proper organization can prevent misunderstandings and legal challenges. Communicate with your children about the location and contents of your estate plan. This transparency helps them navigate the responsibilities they’ll inherit. Avoid leaving a disorganized legacy that complicates their lives unnecessarily.

5. Outdated Digital Footprint

In today’s digital age, managing your online presence is crucial. An outdated digital footprint can create confusion and security risks for your children. Compile a list of your digital accounts, usernames, and passwords, ensuring your executor can access them. Consider setting up a digital legacy plan that specifies how you want your online presence managed. Regularly update this information and inform your family about its location. By organizing your digital assets, you help your children manage your online affairs smoothly and securely, avoiding unnecessary stress and potential identity theft issues.

6. Toxic Possessions

Toxic possessions, such as hoarded items or hazardous materials, can be overwhelming for your children to deal with. Declutter your home and dispose of unnecessary or dangerous items responsibly. Evaluate the emotional and practical value of your belongings, keeping only what truly matters. This process reduces the physical and emotional burden on your children. Involve your family in sorting through possessions to share memories and stories. By addressing these items now, you prevent your children from facing the daunting task of sorting through them later, ensuring a more manageable transition.

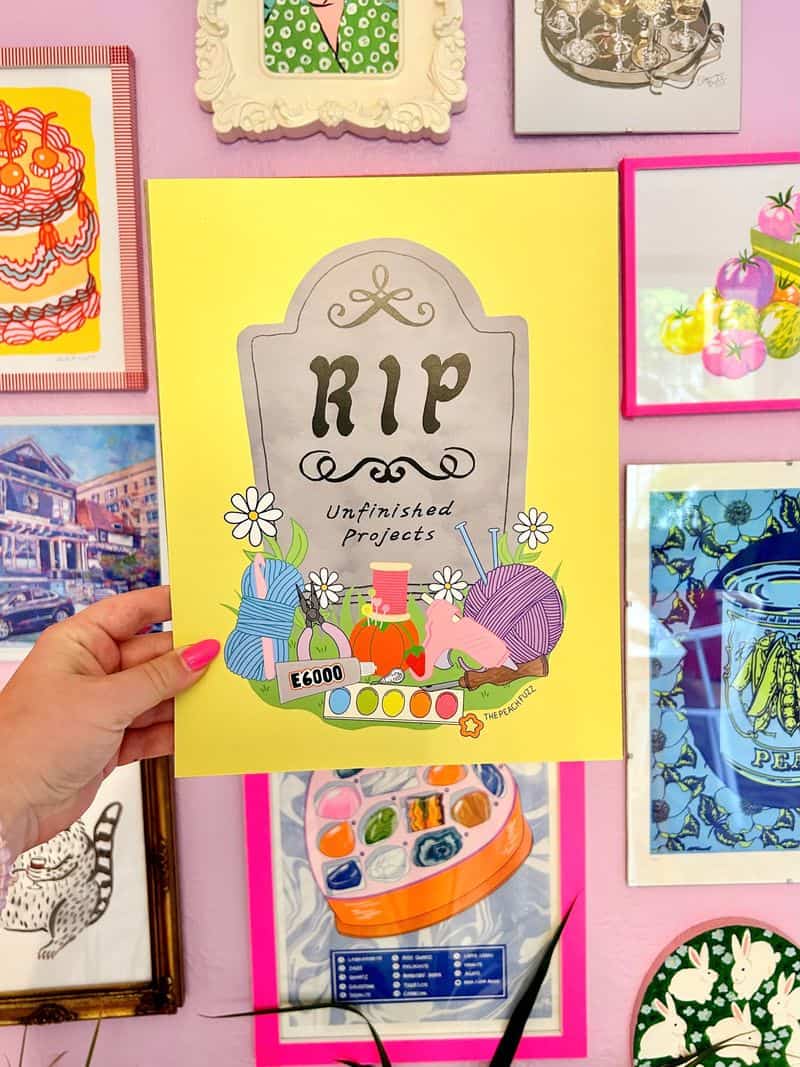

7. Unfinished Projects

Unfinished projects can create emotional and practical burdens for your children. Whether it’s a home renovation, a business venture, or a creative endeavor, strive to complete these tasks. If completion isn’t feasible, consider documenting your vision and instructions for the future. Discuss these projects with your family, sharing your intentions and seeking their input. This preparation helps them decide how to proceed, minimizing stress and uncertainty. By addressing unfinished projects now, you can alleviate potential burdens and ensure your legacy reflects your completed achievements rather than incomplete intentions.

8. Outdated Insurance Policies

Outdated insurance policies can lead to financial confusion and inadequate coverage for your heirs. Review your insurance policies regularly to ensure they align with your current needs and estate plan. Update beneficiaries and coverage amounts as necessary. Consulting with a financial advisor can provide insights into optimizing your insurance strategy. Clear documentation of your policies and their purpose is essential. Share this information with your family so they understand the protection in place. By keeping your insurance up-to-date, you prevent potential headaches for your children and ensure they are adequately covered.

9. Unclear Final Wishes

Leaving unclear final wishes can cause immense confusion and stress among your family members. It’s crucial to document your preferences for end-of-life care, funeral arrangements, and the distribution of your estate. Clearly articulate these wishes in your will and discuss them openly with your family. Consider legal instruments like advance directives to formalize your healthcare wishes. Transparency and communication prevent misunderstandings and help your family honor your intentions. By addressing these matters now, you provide clarity and peace of mind, ensuring your final wishes are respected.

10. Negative Financial Habits

Negative financial habits, like overspending or poor investment decisions, can be unintentionally passed to your children. Model responsible financial behavior by creating a sound budget and sticking to it. Educate your children about managing finances effectively, sharing lessons from your experiences. Consider working with a financial advisor to develop a comprehensive financial plan. Encourage open discussions about money within your family to foster financial literacy. By breaking this cycle of negative habits, you empower your children to make informed decisions, ensuring a stable financial future free from inherited mistakes.

11. Ambiguous Heirlooms and Sentimental Items

Heirlooms and sentimental items can be a beautiful part of your legacy—but when their value or intended recipient isn’t clear, they can become a source of conflict. Without proper guidance, your children may argue over who gets what, or some items may be discarded unintentionally.

Take the time to catalog meaningful possessions and explain their significance. You can label items, include them in your will, or write a letter expressing your wishes. Better yet, have conversations with your family about these items while you’re still here. Clarifying who gets what prevents confusion, honors the emotional value of these belongings, and ensures your cherished memories are passed on with love—not conflict.

Well, hello there!

My name is Jennifer. Besides being an orthodontist, I am a mother to 3 playful boys. In this motherhood journey, I can say I will never know everything. That’s why I always strive to read a lot, and that’s why I started writing about all the smithereens I came across so that you can have everything in one place! Enjoy and stay positive; you’ve got this!