Providing a living inheritance is a trend that many parents are considering, offering financial support to their children while they are still around to witness its impact. However, this approach is not without its caveats. It’s essential to weigh the potential downsides against the perceived benefits. Here are five compelling reasons to reconsider this financial strategy.

1. Financial Dependency Risks

Imagine a young adult, freshly out of college, who begins to rely heavily on financial gifts from their parents. This situation can easily lead to financial dependency, where the child does not learn to manage money independently. Over time, this can foster a sense of entitlement or expectation that financial support will always be there, regardless of circumstances.

Moreover, this dependency can stifle their motivation to achieve personal financial goals or pursue career advancements. It’s crucial for young adults to develop financial skills on their own to be self-sufficient and prepared for life’s challenges.

2. Impact on Parental Finances

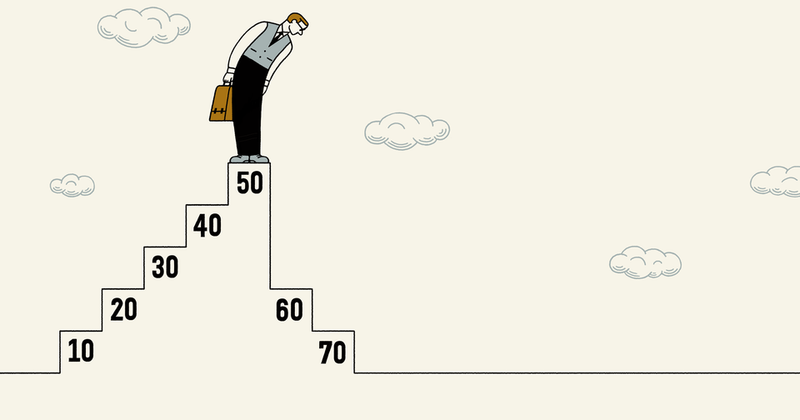

Consider the financial strain on parents who decide to give away a significant portion of their savings prematurely. This decision can adversely affect their retirement plans, leaving them financially vulnerable in their later years.

Parents may find themselves unable to maintain their desired lifestyle or cover unexpected expenses due to diminished resources. By prioritizing their financial security first, parents can ensure they are not a future burden on their children. A careful evaluation of one’s financial health is essential before making such impactful decisions.

3. Diminished Work Ethic

Picture a scenario where a substantial financial gift diminishes a person’s drive to work hard and excel. This can lead to complacency, reducing their ambition and willingness to take risks that could lead to personal and professional growth.

The comfort of financial support may discourage them from exploring opportunities or pursuing higher education and skill development. Encouraging self-reliance and resilience can foster a strong work ethic and a sense of accomplishment in achieving goals independently.

4. Relationship Strain

Family dynamics can become strained when financial gifts are involved. Jealousy or resentment might arise among siblings if one perceives they are treated unfairly compared to another.

Such situations can lead to conflicts, affecting family harmony. Parents might also feel pressured to continue giving, even when it is not financially feasible. Balancing generosity with fairness and open communication is vital to maintain healthy family relationships.

5. Loss of Inheritance Value

Imagine the value of a financial gift eroding over time due to poor investment choices or frivolous spending. The intended purpose of the inheritance may be lost if not managed wisely by the recipient.

Parents might hope for their financial assistance to be a stepping stone for their children, but without proper guidance, it could result in squandered opportunities. It’s vital to educate children on financial literacy, ensuring they understand the importance of preserving and growing their inheritance responsibly.

Mother of three and a primary school teacher. I’ve always loved being around children and helping them, so I chose my path as a teacher. It is sometimes hectic with three children, but I am 100 percent into it and wouldn’t change it for anything in the world.