In today’s increasingly digital age, cash may seem like a relic of the past. However, there are compelling reasons to keep some cash on hand, a practice our parents and grandparents have long championed. Whether it’s for emergencies, convenience, or even budgeting, carrying cash can offer advantages that digital payments simply cannot match.

In this article, we explore six smart reasons to carry cash at all times, right from the perspective of seasoned wisdom. You’ll discover how a simple banknote can be a lifesaver, a bargaining chip, and even a tool for better money management. Let’s explore why cash is still king.

1. Emergency Situations

Picture yourself during a late-night drive through a rural area, and the only open gas station only accepts cash. Situations like these highlight why having cash is a necessity. In emergencies, cash can be a lifesaver. It’s often accepted when digital payments fail due to connectivity issues or power outages.

Moreover, certain emergency services or roadside vendors may only deal in cash. Being prepared for unforeseen circumstances ensures peace of mind. Cash can bridge the gap when technology fails, allowing you to navigate unexpected challenges smoothly.

2. Privacy Concerns

In an age where digital footprints are everywhere, cash offers a level of privacy unmatched by cards. Using cash means fewer trails for hackers or marketers to follow. It keeps your transactions private.

Moreover, for those wary of data breaches, cash is a secure option. It allows you to shop without leaving a digital record. Whether at a local market or a boutique store, cash preserves your anonymity and protects sensitive information.

3. Budgeting and Spending Control

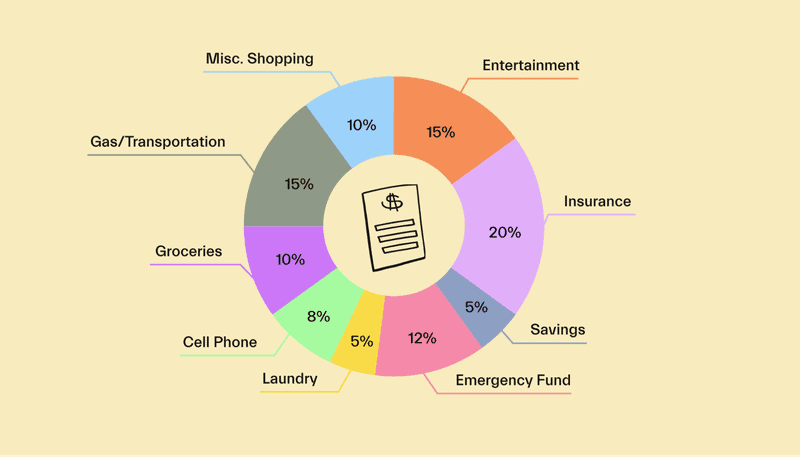

For those looking to manage their budget effectively, cash is an invaluable tool. Physically handling money gives you a tangible sense of spending, making it easier to track expenses. Unlike credit cards, cash prevents overspending by setting a strict limit on purchases.

By withdrawing a set amount weekly, you can control impulsive buys and stick to a budget. This method promotes financial discipline and helps you prioritize essential purchases over luxuries.

4. Cash Discounts

Many businesses offer discounts for cash payments. This is due to reduced transaction fees associated with cash. By paying cash, you can save money on purchases that would otherwise incur extra charges.

Small businesses often appreciate cash transactions, as it cuts costs for them too. So, next time you spot a cash-only discount sign, consider the immediate savings. Supporting local businesses this way can foster community ties and benefit both parties financially.

5. No Reliance on Technology

Imagine attending a bustling outdoor festival with limited network coverage. Cash ensures you can still enjoy the activities, food, and souvenirs without technology hiccups. It doesn’t rely on a stable internet connection, making it a reliable option.

Furthermore, cash is immune to technical glitches or device malfunctions. Whether at a festival or a remote location, cash provides freedom and ease of access to amenities. You won’t have to worry about card readers malfunctioning or battery issues.

6. Bargaining Power

Cash can enhance your bargaining power in markets or informal settings. Vendors often prefer cash as it simplifies transactions and gives them flexibility. Having cash on hand can lead to better deals or discounts.

In environments like flea markets, cash speaks volumes. It can tip the scales in your favor during negotiations. You might find that brandishing some bills could make you a favored customer, leading to more favorable pricing.

Well, hello there!

My name is Jennifer. Besides being an orthodontist, I am a mother to 3 playful boys. In this motherhood journey, I can say I will never know everything. That’s why I always strive to read a lot, and that’s why I started writing about all the smithereens I came across so that you can have everything in one place! Enjoy and stay positive; you’ve got this!